There is currently a claim circulating on social media that compares the use of cash to digital payment methods, particularly in light of the costs involved. The claim is that the costs of digital transactions are significant and that over time these costs can become significant losses through repeated transactions. It is also noted that these costs are charged by banks. Using cash can avoid these costs.

However, this claim is based on a number of assumptions and simplifications that do not necessarily correspond to reality. For example, it is assumed that a fee is incurred for every digital transaction and that this fee is charged again for every subsequent transaction in the chain. In reality, fees vary widely and are not necessarily charged on every transaction.

The claim therefore presents a simplified and sometimes misleading representation of the costs of digital payments compared to cash. It also ignores the potential benefits of digital payments, such as: B. Convenience, security and easier tracking of expenses.

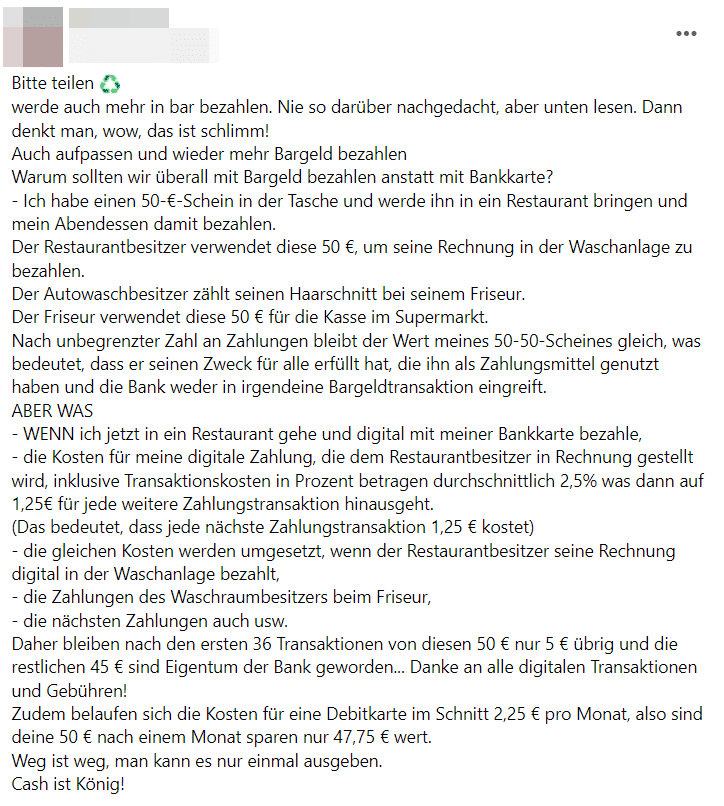

It is this claim:

Fact check digital payments vs. cash

Let’s now look at the claim point by point

“Why should we pay with cash everywhere instead of with a bank card?”

Fact check: Both payment methods, cash and bank card, have their advantages. While cash can be useful in some situations, cards and digital payments often offer greater convenience and security.

“I have a €50 note in my pocket and I'm going to take it to a restaurant and use it to pay for my dinner. The restaurant owner uses this €50 to pay his bill at the car wash. The car wash owner counts his haircut at his barber. The hairdresser uses this €50 for the checkout at the supermarket.”

Fact check: This is possible. The value of the 50 euro note remains the same as long as it is used as a means of payment.

“IF I now go to a restaurant and pay digitally with my bank card, the cost of my digital payment, which is billed to the restaurant owner, including transaction costs as a percentage, is on average 2.5% which then amounts to €1.25 for each additional payment transaction.”

Fact Check: This varies greatly. Some banks and payment providers charge fees, others don't. The exact amount of the fees depends on the bank, the country and the type of transaction.

“The same costs are implemented when the restaurant owner pays his bill digitally at the car wash, the washroom owner’s payments at the hairdresser, the next payments too, etc.”

Fact check: False. It is not necessarily the case that fees are charged at every stage of a transaction chain.

“Therefore, after the first 36 transactions of this €50, only €5 remains and the remaining €45 has become the property of the bank…”

Fact check: False. This assumption is based on a gross exaggeration of average fees and misunderstands how those fees are collected.

“Plus, the cost of a debit card is on average €2.25 per month, so after one month your €50 in savings is only worth €47.75.”

Fact check: The monthly cost of a debit card varies greatly from bank to bank and country to country. Some banks offer free debit cards, while others charge fees. It is important to be aware of what costs may apply.

“Cash is king!”

Fact Check: Although cash can be useful in some situations, digital payments often offer greater convenience, security and, in many cases, are more cost-effective. It depends on your personal situation which method you prefer.

Conclusion

The post's claim about the supposed cost of digital transactions ignores some important facts and is therefore misleading. It is true that some digital transactions may incur fees, but the chain of fees presented is an exaggeration and does not represent the typical experience.

Digital payments can be more convenient and secure than cash payments in many cases, and they can help people better track their spending. The cost of digital transactions varies greatly depending on factors such as the bank, country and type of transaction, and is often lower than shown in the status post.

Overall, it is important to be aware of the potential costs and benefits of both digital payments and cash payments and to choose the payment method that best suits your needs. It is not correct to say that cash is the most cost-effective option in all cases.

Also read:

Fact check: Should you abolish cash?

Rammstein criticized: Lindemann's arrest is fake news

Notes:

1) This content reflects the current state of affairs at the time of publication. The reproduction of individual images, screenshots, embeds or video sequences serves to discuss the topic. 2) Individual contributions were created through the use of machine assistance and were carefully checked by the Mimikama editorial team before publication. ( Reason )