The art of deception: photoTAN scam

The world of electronic banking has always been a breeding ground for fraudsters seeking to steal bank customers' personal and financial information. But now the fraudsters have taken their game to a new level. They not only want personal data, but also the coveted photoTAN letters.

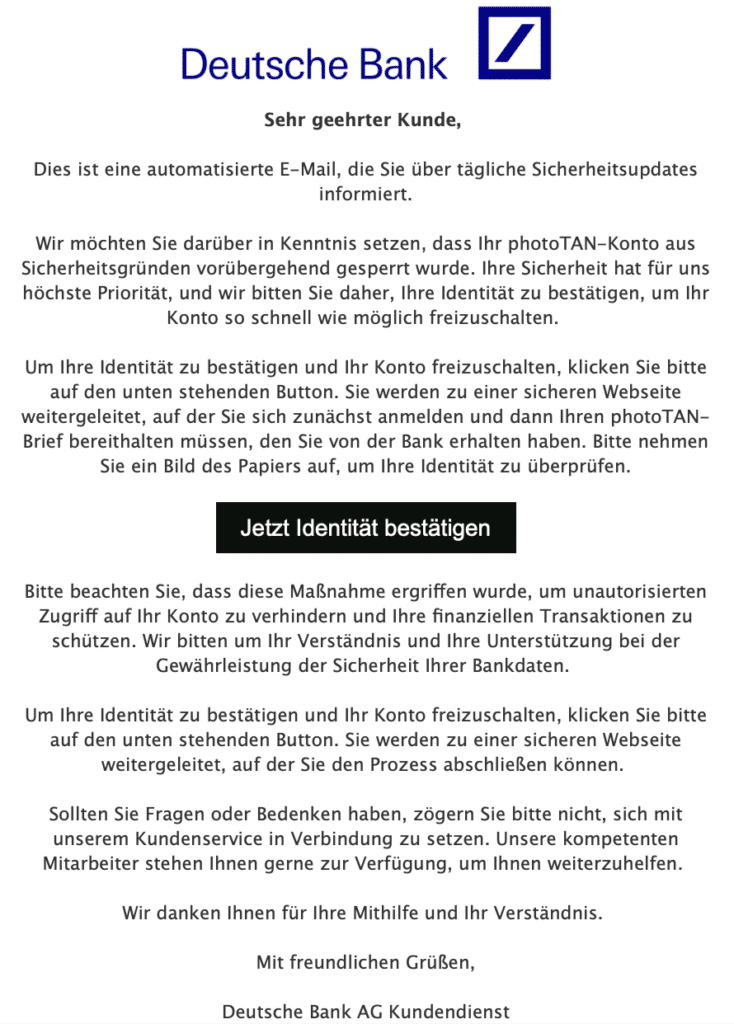

The scam is as perfidious as it is clever. It begins with a seemingly innocuous email claiming that the bank account has been blocked for security reasons. To unblock the account, the customer will be asked to prove their identity - by uploading their photoTAN letter.

However, the link contained in the email does not lead to the Deutsche Bank website, but to a fake page designed to steal the valuable photoTAN data.

Fraudsters gain full access to the account

The irony lies in the fact that the scammers claim that these measures are in place to protect customers and their finances. In fact, entering sensitive data gives fraudsters full and unprotected access to customers' accounts and finances.

Consumer advocates strongly advise against responding to such phishing emails. No data should be disclosed either.

One blow after another: data leak hits Deutsche Bank customers

As if the phishing attack wasn't enough, Deutsche Bank customers were recently hit by a data breach . A third-party account switching service provider experienced a security incident that resulted in the loss of personal information. Names and IBANs were stolen. However, the unknown persons could not access the accounts. However, customer trust has already been damaged.

How can you protect yourself from such scams?

In order to be prepared against these increasingly sophisticated fraud attempts, bank customers should heed a few basic security rules:

- Ignore suspicious emails : Do not open links or attachments in suspicious emails, and never reveal your sensitive information in response to such emails.

- Clear doubts : If you have any doubts, always contact your bank directly to clarify the situation.

- Use the bank's security measures : Use the security measures your bank offers, such as two-factor authentication, and always keep your online banking software up to date.

- Be careful with personal information : Only enter your personal information on safe and trustworthy websites.

The digital world is a double-edged sword. It offers comfort, but also carries risks. However, with the right knowledge and tools, we can navigate the digital world safely and protect ourselves from the digital “predators” that lie in wait.

Source:

Consumer advice center

Already read?

WormGPT: The Chatbot That Helps Cybercriminals Phish

It is a dark irony that the same AI models designed to improve and facilitate human communication are now being used as weapons in the hands of cybercriminals. - Continue reading …

Notes:

1) This content reflects the current state of affairs at the time of publication. The reproduction of individual images, screenshots, embeds or video sequences serves to discuss the topic. 2) Individual contributions were created through the use of machine assistance and were carefully checked by the Mimikama editorial team before publication. ( Reason )