As the police report, an injured 43-year-old from Apolda received an offer for a low-cost loan of 5,000 euros via Facebook and the messenger service there.

After some conversation, the provider informed her that she would first have to transfer 198 euros in fees in order to open a corresponding credit account. However, after further demands followed, she became suspicious and now suspected fraud. She therefore reported the matter on September 16, 2021.

What happened here?

The words “loan offers on Facebook” should set alarm bells ringing for every user. The following always applies: stay away!

Fraudulent loan offers: Are you in financial distress and found out on Facebook about a guy offering loans at ridiculous rates? Then turn down this offer immediately because it is a scammer who will take even more money out of your pocket.

The fraudsters usually copy other profiles and contact potential victims under a false identity. The offers are aimed primarily at people who would no longer be able to get a loan from their bank.

They pretend to have their own capital and are therefore able to grant personal loans - usually at an extremely lucrative interest rate and with an unrealistic term.

Stay away from such loan offers!

Because these always end with the so-called advance payment fraud . If a user responds to the offer, they will quickly be asked for personal information and a copy of their ID.

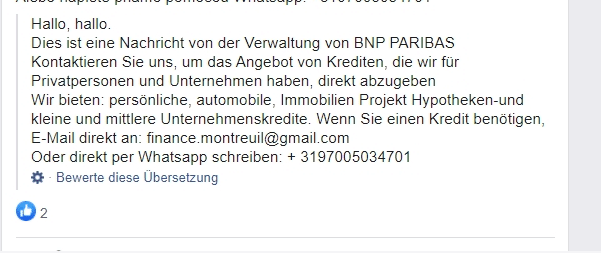

The contracts for such scams look similar to the example below and can be written in any language imaginable:

However, if you sign the contract, you will receive a request from the alleged lender to pay money for various fees or other necessary advance payments... so it is actually an advance payment scam!

Desperate people cling to every straw that is offered to them, so it is understandable that users fall into this trap again and again.

How to spot loan fraudsters on Facebook

- The respective profile often speaks bumpy German

- There is a noticeably low interest rate promise.

- Collateral/hedges are not required

- Dubious email address

Tips to protect yourself from loan scammers on Facebook

- When it comes to dubious loan offers on Facebook, you can be almost certain that fraudsters are behind them.

- You can report suspicious profiles and offers directly to us. To do this, please send an email to [email protected]

- Never give your personal information to strangers ONLINE. It may sound logical, but there are thousands of users who don't think about it.

So if you need a loan, ALWAYS go to your bank first! If your bank doesn't grant you a loan, you won't normally be able to get a loan anywhere else, especially not on Facebook!

Even if such offers seem like the solution to all problems at first glance, NEVER !

In keeping with the topic: Credit trap on Facebook! A real case

Notes:

1) This content reflects the current state of affairs at the time of publication. The reproduction of individual images, screenshots, embeds or video sequences serves to discuss the topic. 2) Individual contributions were created through the use of machine assistance and were carefully checked by the Mimikama editorial team before publication. ( Reason )