Criminals always have new tricks up their sleeves to get personal information and bank details. In the current phishing emails, the attackers pose as trustworthy institutions - such as the tax office or FinanzOnline and the ÖGK - in order to deceive their victims.

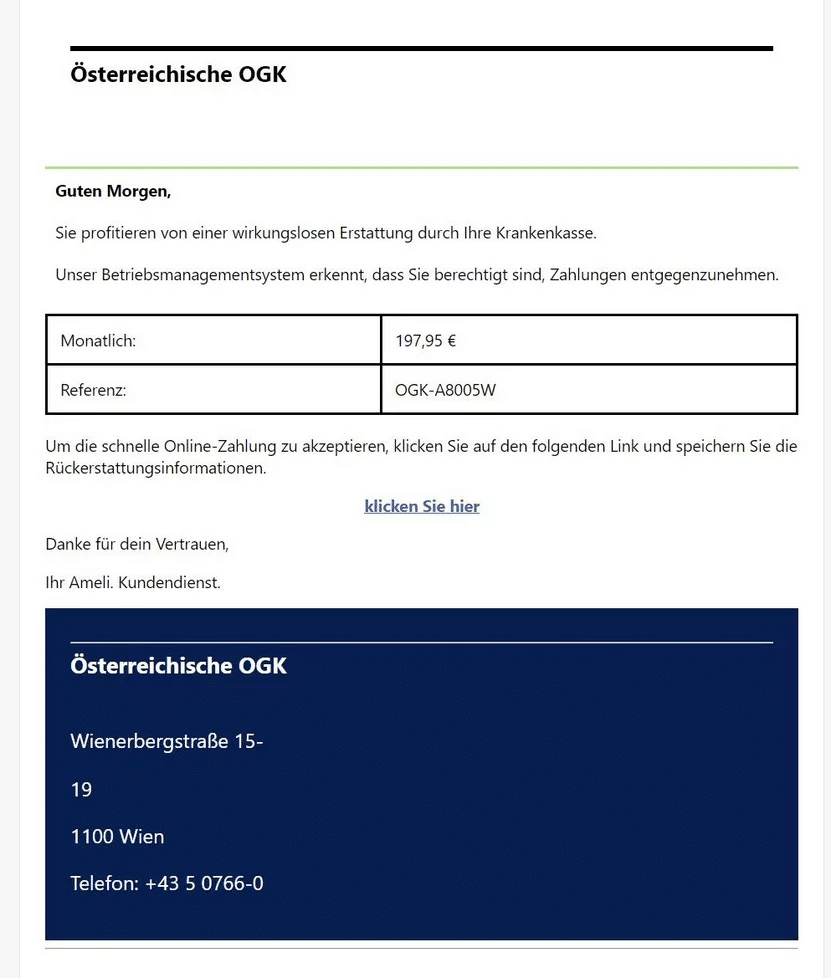

Fake email from ÖGK

In an email supposedly from the Austrian Health Insurance Fund (ÖGK), you will be informed about a refund from your health insurance company. A monthly payment of 197.95 euros is promised. To receive this payment you must click on a link.

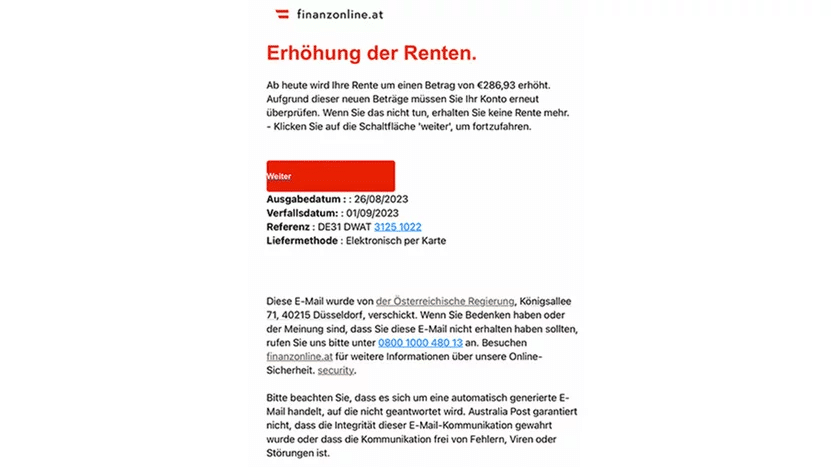

Fake email from FinanzOnline

The fraudulent email from FinanzOnline concerns an alleged pension increase of 286.93 euros. The email will ask you to check your account again. If you do not comply with this request, you will be threatened with no longer receiving your pension.

Do not click on the link

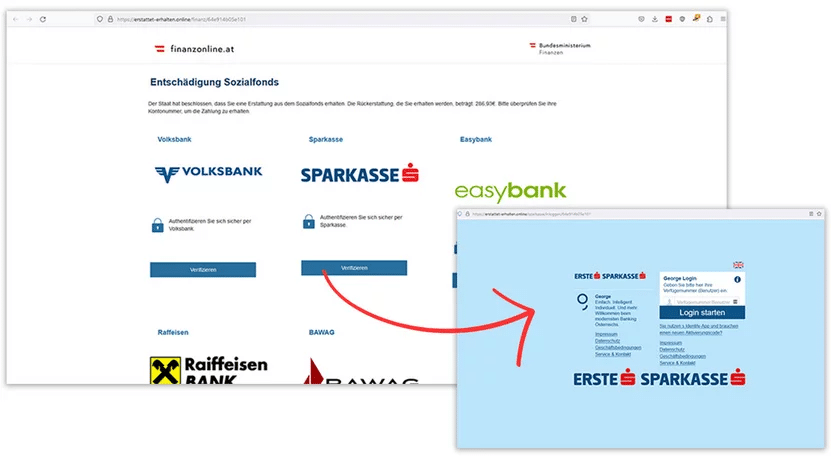

If you click on the links in the emails, you will be taken to fake FinanzOnline or ÖGK websites. Here you will be asked for your bank. If you select this, you will be redirected to a fake login page where criminals end up stealing your information.

Protect yourself from phishing emails

Phishing emails can be very dangerous because their goal is to steal your personal information. You can find out how you can protect yourself from these fraudulent emails here:

- Never click on suspicious links: A link in an email is always suspicious. Therefore, never click on links hastily, especially in emails that you did not expect. If in doubt, go directly to the official website of the institution in question instead of clicking on the link.

- Be wary of requests to rush: Phishing emails often contain requests to act immediately and threaten consequences. Take time to verify the authenticity of the email before taking any action.

- Check the sender: Check the sender's email address. Phishing emails often use unusual or slightly modified sender addresses. Be especially careful if the sender's address doesn't seem plausible.

- Ask: If you are unsure whether an email is genuine, contact the institution the email appears to be coming from directly. Visit the official website or use the official contact options to inquire.

I have given out my bank details – what do I have to do now?

Have you already clicked on the phishing link and entered your bank details? Then you should act immediately:

- Contact your bank: Notify your bank immediately so they can take additional security measures.

- Change passwords : If you have also entered access data for your FinanzOnline or ÖGK account, change the passwords for these accounts immediately to prevent attackers from accessing them.

- Beware of Unusual Calls/Messages: Be wary if you receive unexpected calls or messages claiming to be from your bank or other institution. Criminals may try to get more information from you.

- Report to the police: If you have been the victim of a phishing attack, you should report it to the police so that an investigation can begin.

Conclusion

Phishing emails are a serious threat in the digital world. However, if you are vigilant and follow the advice above, you can effectively protect yourself from this type of attack.

Subscribe to the Mimikama newsletter to receive regular updates on the latest security warnings and tips. Use our extensive media education offering to protect yourself and your family from digital dangers.

Source:

Watchlist Internet

You might also be interested in:

The disastrous click: When phishing hijacks everyday digital life

Beware of fraudulent PayPal calls: How to stay safe

The sneaky “click” – How new waves of SMS fraud are endangering your bank account

Notes:

1) This content reflects the current state of affairs at the time of publication. The reproduction of individual images, screenshots, embeds or video sequences serves to discuss the topic. 2) Individual contributions were created through the use of machine assistance and were carefully checked by the Mimikama editorial team before publication. ( Reason )