The deceptive maneuver: What the fraud emails from Finanzonline look like

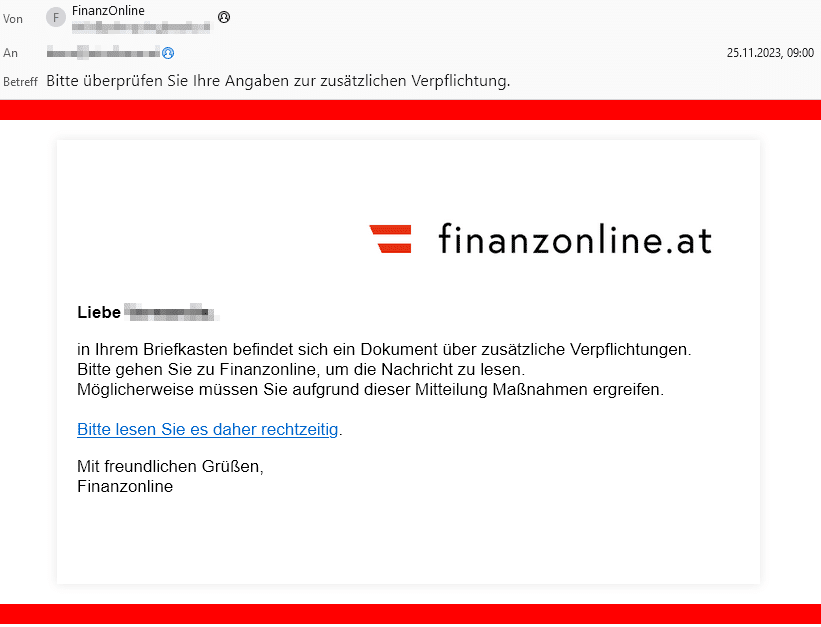

The fake emails appear authentic at first glance. The sender appears as “FinanzOnline”, and the subject encourages you to take the message seriously: “Please check your details about the additional obligation.” The content of the email is precisely worded and asks the recipient to follow a link in order to to review an important document. But this link leads into a trap.

The dangerous link: What happens when you click

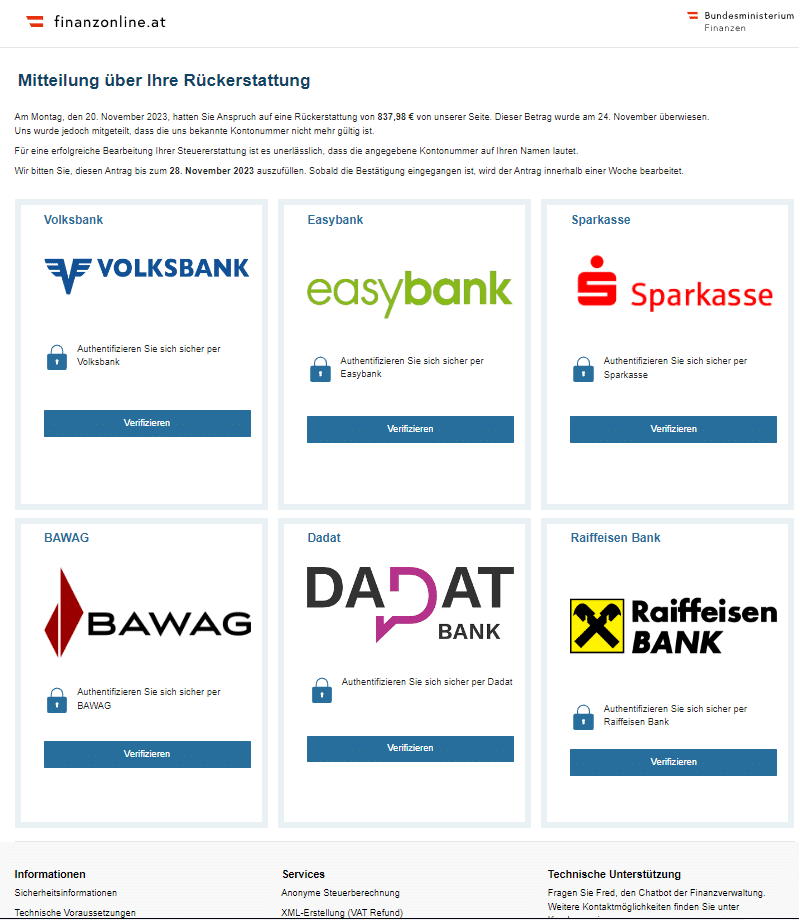

If you follow the instructions and click on the link, you will end up on a fake website. This informs you about an alleged refund and asks you to enter sensitive bank details. This is where the real danger begins: The fraudsters gain access to online banking data by redirecting the victims to deceptively genuine login pages of various banking institutions.

Fraudsters who gain access to online banking data can carry out a variety of malicious activities. Here are the top 5 dangers that arise from such access:

- Fund Transfers : The most obvious and immediate danger is that fraudsters will transfer money from their victims' accounts to their own accounts or those of intermediaries. Such transactions can be completed within minutes, making tracking and chargebacks difficult.

- Identity theft : With access to online banking, fraudsters can view personal information such as address, date of birth and other sensitive data. This information can be used for identity theft, to take out loans, open accounts, or conduct other fraudulent financial activities in your name.

- Credit card fraud : Fraudsters can access credit card information on file and use it to make unauthorized purchases or withdrawals. Often, such transactions are only noticed when the account holder checks their account statements.

- Investment fraud : If the victim manages investment accounts or portfolios through their online banking, fraudsters could manipulate investments, reallocate funds or sell valuable investments.

- Blackmail and fraud : With access to a victim's financial details, fraudsters could also resort to extortion attempts. They could threaten to make sensitive information public or cause further financial harm if their demands are not addressed.

How to protect yourself: identifying features and prevention

- Check the sender's email address carefully.

- Be suspicious of unexpected payment requests.

- Never click on links or attachments in suspicious emails.

- Check the website URL before entering any personal information.

Conclusion:

This fraud case shows how important it is to stay alert and informed. Fraudsters are constantly developing new methods to obtain sensitive data.

Stay informed and protect yourself : Sign up for the Mimikama newsletter and use the Mimikama media education offer to learn about the latest scams and protection measures.

You might also be interested in:

Notes:

1) This content reflects the current state of affairs at the time of publication. The reproduction of individual images, screenshots, embeds or video sequences serves to discuss the topic. 2) Individual contributions were created through the use of machine assistance and were carefully checked by the Mimikama editorial team before publication. ( Reason )