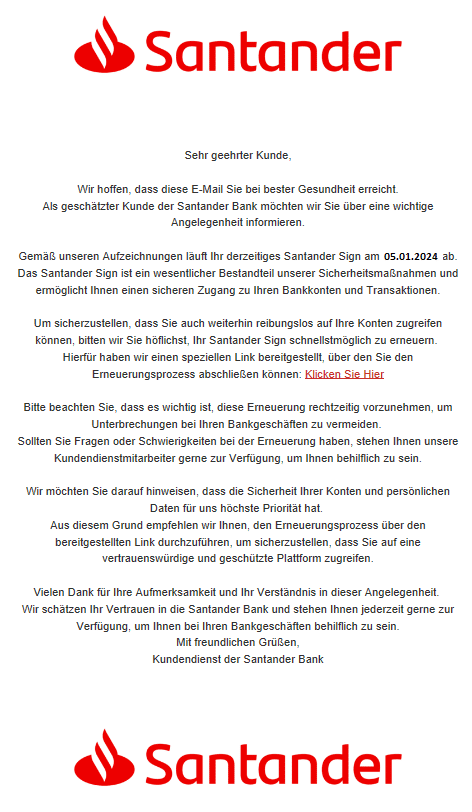

Phishing attacks are a constant threat. A particularly sneaky example is currently circulating: an email in the name of Santander Bank informing customers about an allegedly expired Santander Sign. However, this cleverly disguised and seemingly legitimate message is a trick used by scammers.

Renewal of the Santander logo

The email refers to a link that supposedly allows the Santander sign to be renewed. But be careful: the link does not lead to the real Santander website, but to a fake version that serves the scammers.

Customers who enter their personal and financial information on this site in good faith risk becoming victims of identity theft and financial loss.

How do I recognize a fake email?

It can be difficult to detect phishing attempts as scammers become more sophisticated. However, there are some signs that indicate a fake email:

- Unusual sender address: Check the sender address. If it differs from the official domain of Santander Bank, suspicion is appropriate.

- Urgency and scaremongering: Phishing emails often use the tactics of urgency or scaremongering to persuade the recipient to act quickly.

- Grammar and spelling errors: Professional organizations such as banks attach great importance to correct language. Noticeable errors are a warning sign.

- Data verification links: Banks generally do not request sensitive data via email. Check links by hovering over them without clicking.

What do you do if you receive such an email?

If you receive such an email, it is important to remain calm and follow the steps below:

- Do not open links or attachments: These could install malware on your device.

- Contact the bank directly: Use the official contact details to verify the authenticity of the email.

- Notify the appropriate authorities: Report the phishing attempt to help other potential victims.

Protective measures against phishing

To protect yourself from phishing and other scams, you should

- Update your software regularly: This closes security gaps.

- Use strong, unique passwords: Use password managers for added security.

- Set up two-factor authentication: This additional layer of security can protect against unauthorized access.

Questions and answers:

Question 1: How can I be sure that an email really comes from my bank?

Answer 1: Check the sender address carefully, pay attention to the language of the email and do not hesitate to contact your bank directly through the official channels to verify the authenticity of the email.

Question 2: What should I do if I clicked on a phishing link?

Answer 2: Immediately change any affected passwords, run a virus scan on your device, and inform your bank and relevant authorities.

Question 3: How can I generally protect myself better against phishing?

Answer 3: Use strong, unique passwords, enable two-factor authentication, and stay up to date on current fraud schemes.

Conclusion

It's important to stay up to date on the latest scams and share this knowledge with family and friends. Education and awareness are effective tools in the fight against online fraud.

Remember: your personal and financial information is valuable - protect it accordingly.

For more information and up-to-date alerts, subscribe to the Mimikama newsletter . You can also register for our online lectures and workshops . Stay safe and informed to protect yourself and your loved ones from digital threats.

Also read:

Notes:

1) This content reflects the current state of affairs at the time of publication. The reproduction of individual images, screenshots, embeds or video sequences serves to discuss the topic. 2) Individual contributions were created through the use of machine assistance and were carefully checked by the Mimikama editorial team before publication. ( Reason )